Some Known Factual Statements About International Debt Collection

Wiki Article

The Only Guide for Personal Debt Collection

Table of ContentsAbout Business Debt CollectionGet This Report about International Debt CollectionSome Known Facts About Private Schools Debt Collection.Business Debt Collection Things To Know Before You Get ThisGetting My Business Debt Collection To Work

You can ask an enthusiast to quit contacting you as well as challenge the financial debt if you believe it's inaccurate.: agree to a repayment plan, clean it out with a solitary repayment or negotiate a settlement.

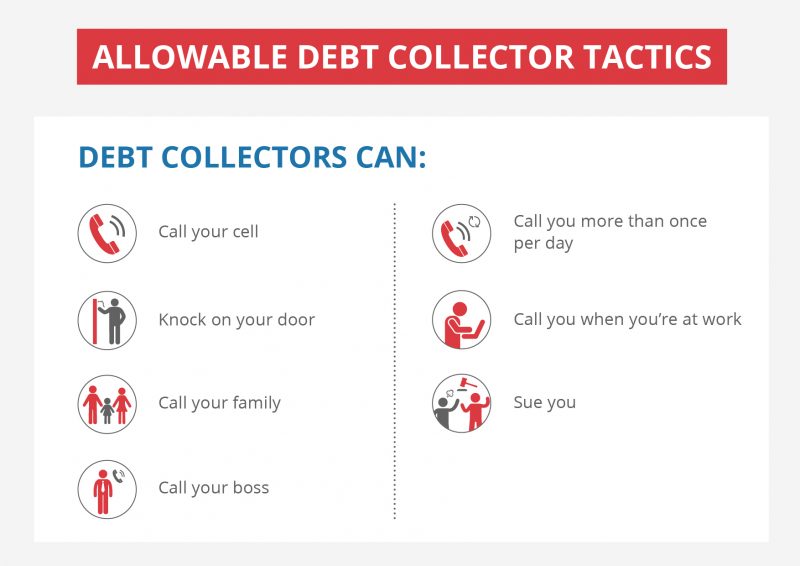

If you do not have a lawyer, the agency can call various other people only to learn where you live or work. The collection agency can not tell these people that you owe cash. The collection firm can get in touch with another individual just once. These very same rules apply to contact with your employer.

It can, but does not have to approve a partial payment plan (Business Debt Collection). An enthusiast can ask that you write a post-dated check, but you can not be needed to do so. If you offer a collection firm a post-dated check, under government law the check can not be transferred before the day written on it

The very best financial debt collection agency job summaries are concise yet engaging. Give details regarding your firm's worths, mission, as well as society, as well as allow prospects know just how they will contribute to business's development. Consider utilizing bulleted lists to boost readability, including no even more than 6 bullets per area. Once you have a strong initial draft, evaluate it with the hiring supervisor to make sure all the info is accurate and the needs are purely important.

Unknown Facts About Dental Debt Collection

The Fair Financial Debt Collection Practices Act (FDCPA) is a federal law implemented by the Federal Trade Commission that safeguards the rights of customers by prohibiting specific techniques of financial debt collection. The FDCPA applies to the practices of financial obligation collection agencies as well as lawyers. It does not apply to creditors who are trying to recuperate their own financial obligations.

The FDCPA does not apply to all financial debts. It does not use to the collection of company or company financial obligations.

It is not intended to be legal advice regarding your specific trouble or to alternative to the recommendations of an attorney.

Top Guidelines Of Debt Collection Agency

Personal, family and family debts are covered under the Federal Fair Debt Collection Act. This includes cash owed for medical treatment, fee accounts or auto purchases. Business Debt Collection. A financial debt collection agency is anyone apart from the financial institution who on a regular basis collects or attempts to accumulate debts that are owed to others which resulted from consumer dealsWhen a debt collector has alerted you by phone, he or she must, within 5 days, send you a created notification exposing the amount you owe, the name of the financial institution to whom you owe cash, as well as what to do if you contest the financial debt. A financial debt collector might NOT: bug, oppress or abuse anyone (i. read the article

You can stop a financial obligation enthusiast from calling you by writing a letter to the collection firm informing him or her to quit. Once the firm gets your letter, it may not call you once more other than to notify you that some certain action will be taken. A financial obligation enthusiast may not call you if, within 1 month after the collection agency's first call, you send the enthusiast a letter specifying that you do not owe the cash.

All about International Debt Collection

This material is readily available in alternate layout upon request.

Rather, the lender might either get a company that is worked with to gather third-party debts or sell the financial obligation to a collection firm. As soon as the debt has been sold to a financial obligation debt collection agency, you might begin to get phone calls and/or letters from that agency. The financial obligation collection sector is greatly controlled, and also borrowers have lots of rights when it concerns taking care of bill enthusiasts.

Despite this, financial debt collectors will certainly attempt every little thing in their power to obtain you to pay your old financial debt. A financial debt collector can be either a private person or a company.

Financial debt collection companies are employed by lenders as well as are normally paid a percent of the quantity of the financial obligation they recover for the creditor. The percentage a collection firm charges is typically based on the age of the financial obligation and also the quantity of the financial debt. Older financial debts or higher financial obligations may take even more time to accumulate, so a debt collector could bill a greater percentage for gathering those.

Rumored Buzz on Dental Debt Collection

Others work on a backup basis as well as just bill the creditor if they are effective in gathering on the debt. The debt collection firm participates in an arrangement with the creditor to collect a percent of the financial obligation the portion is specified by the financial institution. One financial institution may not agree to resolve for less than the full amount owed, while an additional might approve a pop over to this web-site negotiation for 50% of the financial debt.Report this wiki page